Getting Started With Your Credit Union Personal Loan Or Line Of Credit

Whether you’re looking for personal loans in Miami or a personal line of credit with a low rate from a credit union, TFCU can help. Our personal loans and PLOCs are designed with members in mind especially when life challenges us most. Check out the benefits for our personal loans and PLOCs.

Personal Loan

-

Competitive fixed rate, fixed term and fixed monthly payment

-

No origination fee or prepayment penalty

Show Additional Benefits Show Less

-

Simple online application and funding process

-

Loans from $500-$10,000 with secured and unsecured options

Personal Line of Credit

-

Competitive rates and terms compared to most lenders

-

No origination fee or prepayment penalty

Show Additional Benefits Show Less

-

Simple online application and funding process

-

Loans from $500-$10,000 with secured and unsecured options

Check Out Our Personal Loan & Line Of Credit Rates In Florida

Finding the best rates for personal loans and lines of credit can be difficult. Check out our different rates to help you determine which option is best for you.

Rates effective as of March 2, 2026

Rates as Low as

11.99% APR*

Unsecured Loan (Fixed Rate)Payment Term: Up to 60 months. Other conditions may apply.

13.75% APR*

Unsecured Line of Credit (Variable Rate)Payment Term: Revolving credit line. Variable rate based on prime rate. Other conditions may apply.

2.55% APR*

Savings Secured Line of Credit (Variable Rate)Payment Term: Revolving credit line. Variable rate based on current savings rate +2.50. Other conditions may apply.

Use The Personal Loan Or Line Of Credit Calculator For An Estimate Of Your Monthly Payments

Use the rates you see from above to calculate what your monthly credit union personal loan of PLOC payment could be. Remember, the rate you qualify for may differ depending on a variety of factors including the term you select and your credit score.

What is a Personal Loan?

A personal loan is money borrowed in a one-time amount that you pay back in fixed monthly payments over a certain period of time. Typically, personal loans are unsecured which means they are not backed by things such as a car, house, etc. However, credit and proof of income are required for eligibility in most cases.

What is a Personal Line of Credit and Secured Line of Credit?

A line of credit, whether it be personal or secured is a revolving account in which a borrower can draw from when they need it. Similar to a credit card there’s a limit on the amount someone can borrow and the amount borrowed must be paid back. Personal lines of credit are typically unsecured and require good credit scores and proof of income. Similarly, secured lines of credit work the same, however savings accounts are used as collateral.

How Can A Credit Union Personal Line of Credit Help Me?

Understanding the difference between a credit union personal loan and a personal line of credit is important. Depending on your situation one may be more beneficial to you than the other.

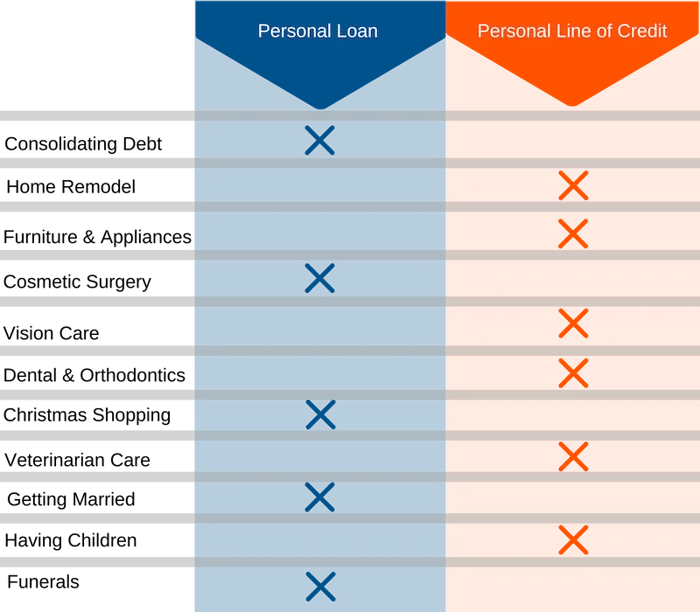

Best Ways To Use A Personal Loan Or Line Of Credit In Miami

There are many different reasons and ways someone could use a personal loan or line of credit in Florida. We’ve gathered some of the top reasons and paired them to which option could work best. See below:

How Does The Personal Loan Process Work?

Getting a personal loan in Florida shouldn’t feel overwhelming. We make it simple to get the money you need to do the things you want. Here’s what you can expect:

COMPARE

Is a personal loan or line of credit the better choice for you? We can guide you through the pros and cons of each to help you decide which option is best for you.

APPLY

Once you decide which option is right for you, the next step is to apply. And to help you along your journey, we have made the application process so easy.

RELAX

Our trusted Personal Loan Advisors will continue to guide you through the process so you don't have to worry about a thing. They'll be with you every step of the way.

CLOSE

Getting a personal loan has never felt so easy. Just imagine how good you will feel when you get the money you need to do the things you want at a low-interest rate.

Getting A Personal Loan Is Quick And Easy

Florida Personal Loan & Line Of Credit FAQ

-

How Do I Qualify for a Florida Personal Loan?

-

Depending on the type of loan you choose collateral may or may not be needed. However, in most instances qualifying for a personal loan is determined by your credit score and monthly income. If you know you will be applying for a personal loan click here for resources to help you prepare.

-

-

What are my options to pay my TFCU loan?

-

Loan payment options:

Transfer from another TFCU account that you are an owner of In Online Banking go to ADDITIONAL SERVICES and register to make a payment

Direct a portion of your payroll/direct deposit to the loan - speak to your HR/payroll department

Visit a Shared Branch facility click here

Call our Call Center with a credit card ( a service fee will be applied) 888-261-8328

Complete an origination form and the funds will be taken automatically from your institution - complete and fax back to ATTN: ACH/Payroll 954-499-6793

Mail to:

Tropical FCU

ATTN: Operations

PO BOX 829517

Pembroke Pines FL 33082-9917

-

-

What Documents Are Needed for a Credit Union Personal Loan?

-

Most lenders will ask for similar documentation when it comes to personal loans and lines of credit. The most common types of documentation needed are:

- Valid driver’s license or government issued ID

- Proof of income, such as paystubs and/or bank statements

-

-

Why Do Personal Loans Have Higher Interest Than Other Loans (Mortgage & Auto)?

-

Since most personal loans and lines of credit are not backed by collateral the interest rate is often much higher than those that are such as home and auto.

Searching for personal loans from a credit union can often be beneficial as they tend to offer competitive rates.

-

-

Will a Personal Loan Affect My Credit Score?

-

Applying for a personal loan or line of credit will impact your credit score as it is considered a hard pull. If you plan on applying, this needs to be done as personal loans and line of credit are determined by credit score and income.

-

Have a Question but Don’t Want to Wait On Hold?

* APR = Annual Percentage Rate. Eligibility for the lowest advertised rate is based on creditworthiness, ability to repay, credit score and terms. Other rates and terms may apply and your actual rate, term and payment may vary depending on your credit history, loan amount and other factors. Not all applicants will qualify for the lowest rate. Rates quoted assume excellent borrower credit history. Other eligibility requirements may apply. Current TFCU accounts must be in good-standing, not have any type of restrictions, and TFCU loans paid-to-date. Member must reside in a state within TFCU lending area.

+Personal Line of Credit APR will vary based on creditworthiness. The variable APR is based on, and changing with, the Prime Rate as published in the Wall Street Journal, plus or minus a margin percentage based on Credit Worthiness. Member must reside in a state within TFCU lending area. Other restrictions may apply. Current TFCU accounts must be in good-standing, not have any type of restrictions, and TFCU loans paid-to-date.

Savings Secured Line of Credit. The standard APR equals the Current TFCU savings account rate + 2.50. The variable APR may increase or decrease based on the current TFCU savings account rate. Share Secured Line of Credit requires a qualifying savings account as collateral.

Rates and terms are subject to change without notice. TFCU will deposit the $1 minimum requirement to open your account. Example: $5,000 loan at 10.99% APR with 60 monthly payments of approximately $108.72.