Learn About TFCU Home Loans

Not sure what you’re getting into with a Florida mortgage?

Learn about the different types of mortgages TFCU offers like:

Fixed Rates

A fixed-rate mortgage is a type of home loan where the interest rate remains constant throughout the entire term of the loan (typically 15 or 30 years). This means that the borrower pays the same amount of interest every month, providing borrowers with stability and predictability in their monthly housing expenses.

Jumbo Rates

Jumbo mortgages are designed for financing higher-priced properties or luxury homes that require larger loan amounts than traditional conforming loans. These loans are above $832,750.

Adjustable Rates

An adjustable-rate mortgage (ARM) is a home loan with an interest rate that can change periodically, often starting with a lower rate than fixed-rate mortgages but potentially fluctuating over time, impacting monthly payments.

Compare Florida Home Loan Interest Rates

South Florida mortgage rates are rising, but ours don’t have to.

Compare our rates and save hundreds or even thousands on your home loan.

Rates effective as of January 26, 2026

5.875%*

30-year (fixed rate)Discount Points:0.750

6.050% APR**

- 359 payments of $887.31 at a rate of 5.875%

- 1 payment of $883.95 at a rate of 5.875%

If an escrow account is required or requested, the actual monthly payment will also include amounts for real estate taxes and homeowner's insurance premiums.

The information provided assumes the purpose of the loan is to purchase a property, with a loan amount of $150,000 and an estimated property value of $200,000. The property is located in Miramar, FL, and is within Broward County. The property is an existing single-family home and will be used as a primary residence. An escrow (impound) account is required. The rate lock period is 45 days and the assumed credit score is 740.

- 359 payments of $887.31 at a rate of 5.875%

- 1 payment of $883.95 at a rate of 5.875%

5.000%*

15-year (fixed rate)Discount Points:1.125

5.345% APR**

- 179 payments of $1186.19 at a rate of 5.000%

- 1 payment of $1186.27 at a rate of 5.000%

If an escrow account is required or requested, the actual monthly payment will also include amounts for real estate taxes and homeowner's insurance premiums.

- 179 payments of $1186.19 at a rate of 5.000%

- 1 payment of $1186.27 at a rate of 5.000%

If an escrow account is required or requested, the actual monthly payment will also include amounts for real estate taxes and homeowner's insurance premiums.

5.625%*

30 Year Jumbo (fixed rate)Discount Points:0.250

5.667% APR**

At a 5.625% interest rate, the APR for this loan type is 5.667%. The payment schedule would be:

- 359 payments of $4796.66 at a rate of 5.625%

- 1 payment of $4794.00 at a rate of 5.625%

At a 5.625% interest rate, the APR for this loan type is 5.667%. The payment schedule would be:

- 359 payments of $4796.66 at a rate of 5.625%

- 1 payment of $4794.00 at a rate of 5.625%

5.500%*

15-year Jumbo (fixed rate)Discount Points:0.875

5.669% APR**

At a 5.500% interest rate, the APR for this loan type is 5.669%. The payment schedule would be:

- 179 payments of $6808.35 at a rate of 5.500%

- 1 payment of $6807.80 at a rate of 5.500%

If an escrow account is required or requested, the actual monthly payment will also include amounts for real estate taxes and homeowner's insurance premiums.

At a 5.500% interest rate, the APR for this loan type is 5.669%. The payment schedule would be:

- 179 payments of $6808.35 at a rate of 5.500%

- 1 payment of $6807.80 at a rate of 5.500%

If an escrow account is required or requested, the actual monthly payment will also include amounts for real estate taxes and homeowner's insurance premiums.

4.875%*

5/6 ARM (variable rate)Discount Points:0.375

5.571% APR**

Important Loan Information

The information provided assumes the purpose of the loan is to purchase a property, with a loan amount of $350,000 and an estimated property value of $500,000. The property is located in Miramar, FL, and is within Broward County. The property is an existing single-family home and will continue to be used as a primary residence. An escrow (impound) account is required. The rate lock period is 45 days and the assumed credit score is 780.

At a 4.875% initial interest rate, the APR for this loan type is 5.571%, subject to increase. Based on current market conditions, the payment schedule would be:

- 60 payments of $1852.23 at a rate of 4.875%

- 299 payments of $2042.64 at a rate of 5.875%

- 1 payment of $2045.50 at a rate of 5.875%

If an escrow account is required or requested, the actual monthly payment will also include amounts for real estate taxes and homeowner's insurance premiums.

Important Loan Information

The information provided assumes the purpose of the loan is to purchase a property, with a loan amount of $350,000 and an estimated property value of $500,000. The property is located in Miramar, FL, and is within Broward County. The property is an existing single-family home and will continue to be used as a primary residence. An escrow (impound) account is required. The rate lock period is 45 days and the assumed credit score is 780.

At a 4.875% initial interest rate, the APR for this loan type is 5.571%, subject to increase. Based on current market conditions, the payment schedule would be:

- 60 payments of $1852.23 at a rate of 4.875%

- 299 payments of $2042.64 at a rate of 5.875%

- 1 payment of $2045.50 at a rate of 5.875%

If an escrow account is required or requested, the actual monthly payment will also include amounts for real estate taxes and homeowner's insurance premiums.

4.875%*

Jumbo 5/6 ARM (variable rate)Discount Points:0.000

5.513% APR**

- 60 payments of $4409.63 at a rate of 4.875%

- 299 payments of $4862.95 at a rate of 5.875%

- 1 payment of $4864.48 at a rate of 5.875%

If an escrow account is required or requested, the actual monthly payment will also include amounts for real estate taxes and homeowner's insurance premiums.

- 60 payments of $4409.63 at a rate of 4.875%

- 299 payments of $4862.95 at a rate of 5.875%

- 1 payment of $4864.48 at a rate of 5.875%

If an escrow account is required or requested, the actual monthly payment will also include amounts for real estate taxes and homeowner's insurance premiums.

Discover a smarter way to buy or sell your home with HomeAdvantage®—your ultimate real estate partner. From finding your dream home to connecting with experienced, trusted agents, HomeAdvantage® is here to guide you every step of the way. Plus, when you buy or sell through the program, you can earn substantial cash rewards that go straight back into your pocket.

Start your journey to homeownership with the confidence and support you deserve. HomeAdvantage® makes it easier, rewarding, and stress-free.

First Time Home Buyer Loans

For those who haven’t owned a home within the past three years or are looking for a first time home loan from a credit union can benefit from applying with Tropical Financial Credit Union. Our program offers as little as 3% down, low home loan rates and special incentives for qualified members. Here’s the full list of benefits from TFCU’s First Mortgage Program:

- No intangible tax

- Buy a home with as little as 3% down payment

- Special member pricing on Private Mortgage Insurance (PMI)

- No Prepayment Penalties

- HomeAdvantage Program that includes home search, home calculators and special rebate at closing

- Access to the TFCU Mortgage App (upload time sensitive documents, track your mortgage process, quick contact to realtors and MLOs)

- Local staffing to provide education and guidance on your particular mortgage area

A Guide To Buying A House In Florida

Follow our Florida home buying guide so that you can have peace of mind throughout the entire home buying process in Florida.

Taking the time to get financially prepared helps you to stay organized during the home buying process.

Getting pre-approved for a mortgage with a credit union helps you to know how much you can borrow, which creates an easier home buying experience.

Our trusted MLO's guide you through every step of the home buying process, from the beginning and even after the end.

Preparing For Your Credit Union Mortgage

STEP 1: GET PREPARED TO BUY YOUR HOUSE

Taking time to get financially prepared before applying for your mortgage helps you to have a happier home buying process. And while everyone's situation is different, the following are some of the factors we consider when reviewing your mortgage application.

Credit Score

Your credit score is a number between 300 to 850 and is provided by credit bureaus who review your payment, spending, and credit history. A higher credit score helps make it easier to get approved for your home loan if your credit report also shows you always pay your bills on time.

Take action: Get a free yearly credit report here and learn what your credit score is before applying for your mortgage.

Job Stability

While we don't have specific rules for judging employment history, we do want to see a pattern of proven income stability.

Take action: Try to apply for your mortgage when you have been at your current job for at least two or more years. If it's less than that, don't worry as we look at all of your individual employment factors during the mortgage approval process.

Step 2: Getting Pre-Qualified For A Mortgage In Florida

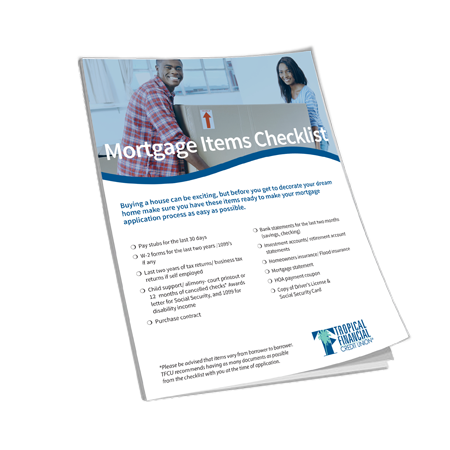

Getting Qualified for a mortgage helps you to know how much you can borrow, which makes home buying an easier process. When applying for a pre-qualification make sure to use our “Mortgage Items Checklist” to stay on top of all mortgage documents.

Step 3: Purchasing Your New Home In South Florida

We’ve partnered with CU Realty Services to bring you exclusive access to HomeAdvantage. Search the most up to date listings on the NLMS, look up statistics about your current and future neighborhood and connect with local realtors. When you use a HomeAdvantage real estate agent, they can help you save hundreds with special rebate promotions!

Search online property listings and compare house recent sales, demographic, crime, and school district rating data.

Our Trusted Real Estate Agents help you negotiate the price for your new home or take the frustration out of selling your existing home.

Our Trusted Real Estate Agents can help you save an average of $1,545** when you work with them to buy or sell your house.

Get Answers To Common Home Buying Questions

-

Can I Apply for a Mortgage Before I Find a House to Purchase?

-

Yes, applying for a mortgage loan before you find a home may be the best thing you could do! If you apply for your mortgage now, we'll issue a pre-approval, based on the information you provide, subject to you finding the perfect home.

Apply Now In Less Than 10 Minutes

The more accurate you are with your information, the more valid your pre-approval will be. We'll issue a pre-approval letter online instantly. You can use the pre-approval letter to assure real estate brokers and sellers that you are a qualified buyer. Having a pre-approval for a mortgage may give more weight to any offer to purchase that you make.

When you find the perfect home, you'll simply call your Mortgage Loan Originator to complete your application and provide the required supporting documents.

-

-

Is Comparing APRs the Best Way to Decide Which Lender Has the Lowest Rates and Fees?

-

The Federal Truth in Lending law requires that all financial institutions disclose the APR when they advertise a rate. The APR is designed to present the actual cost of obtaining financing, by requiring that some, but not all, closing fees are included in the APR calculation. These fees in addition to the interest rate determine the estimated cost of financing over the full term of the loan. Since most people do not keep the mortgage for the entire loan term, it may be misleading to spread the effect of some of these up front costs over the entire loan term.

Also, unfortunately, the APR doesn't include all the closing fees and lenders are allowed to interpret which fees they include. Fees for things like appraisals, title work, and document preparation are not included even though you'll probably have to pay them.

For adjustable rate mortgages, the APR can be even more confusing. Since no one knows exactly what market conditions will be in the future, assumptions must be made regarding future rate adjustments.

You can use the APR as a guideline to shop for loans but you should not depend solely on the APR in choosing the loan program that's best for you. Look at total fees, possible rate adjustments in the future if you're comparing adjustable rate mortgages, and consider the length of time that you plan on having the mortgage.

Don't forget that the APR is an effective interest rate--not the actual interest rate. Your monthly payments will be based on the actual interest rate, the amount you borrow, and the term of your loan.

-

-

Should I Pay Points in Exchange for a Lower Interest Rate?

-

Points are considered a form of interest. Each point is equal to one percent of the loan amount. You pay them, up front, at your loan closing in exchange for a lower interest rate over the life of your loan. This means more money will be required at closing, however, you will have lower monthly payments over the term of your loan.

Click here to calculate and see if points make sense for you.

-

-

What Are Closing Fees and How Are They Determined?

-

A home loan often involves many fees, such as the appraisal fee, title charges, closing fees, and state or local taxes. These fees vary from state to state and also from lender to lender. Any lender or broker should be able to give you an estimate of their fees, but it is more difficult to tell which lenders have done their homework and are providing a complete and accurate estimate. We take quotes very seriously. We've completed the research necessary to make sure that our fee quotes are accurate to the city level - and that is no easy task!

To assist you in evaluating our fees, we've grouped them as follows:

Third Party Fees

Fees that we consider third party fees include the appraisal fee, the credit report fee, the settlement or closing fee, the survey fee, tax service fees, title insurance fees, flood certification fees, and courier/mailing fees.

Third party fees are fees that we'll collect and pass on to the person who actually performed the service. For example, an appraiser is paid the appraisal fee, a credit bureau is paid the credit report fee, and a title company or an attorney is paid the title insurance fees.

Typically, you'll see some minor variances in third party fees from lender to lender since a lender may have negotiated a special charge from a provider they use often or chooses a provider that offers nationwide coverage at a flat rate. You may also see that some lenders absorb minor third party fees such as the flood certification fee, the tax service fee, or courier/mailing fees.

Taxes and other unavoidables

Fees that we consider to be taxes and other unavoidables include: State/Local Taxes and recording fees. These fees will most likely have to be paid regardless of the lender you choose. If some lenders don't quote you fees that include taxes and other unavoidable fees, don't assume that you won't have to pay it. It probably means that the lender who doesn't tell you about the fee hasn't done the research necessary to provide accurate closing costs.

Lender Fees

Fees such as points, administration fees, document preparation fees, and loan processing fees are retained by the lender and are used to provide you with the lowest rates possible.

This is the category of fees that you should compare very closely from lender to lender before making a decision.

Required Advances

You may be asked to prepay some items at closing that will actually be due in the future. These fees are sometimes referred to as prepaid items.

One of the more common required advances is called "per diem interest" or "interest due at closing." All of our mortgages have payment due dates of the 1st of the month. If your loan is funded on any day other than the first of the month, you'll pay interest, from the date of funding through the end of the month, at closing. For example, if the loan is closed on June 15, we'll collect interest from June 15 through June 30 at closing. This also means that you won't make your first mortgage payment until August 1. This type of charge should not vary from lender to lender, and does not need to be considered when comparing lenders. All lenders will charge you interest beginning on the day the loan funds are disbursed. It is simply a matter of when it will be collected.

If an escrow or impound account will be established, you will make an initial deposit into the escrow account at closing so that sufficient funds are available to pay the bills when they become due.

If your loan requires mortgage insurance, mortgage insurance payments may be collected at closing. Whether or not you must purchase mortgage insurance depends on the percentage of the down payment you make.

If your loan is a purchase, you'll also need to pay for your first year's homeowner's insurance premium, flood and wind if applicable, prior to closing. The policies must be purchased and paid in full prior to closing and we consider this to be a required advance.

-

-

How Do I Know if It’s Best to Lock In My Interest Rate or to Let It Float?

-

Mortgage interest rate movements are as hard to predict as the stock market and no one can really know for certain whether they'll go up or down.

If you have a hunch that rates are on an upward trend then you'll want to consider locking the rate as soon as you are able. Before you decide to lock, make sure that your loan can close within the lock in period. It won't do any good to lock your rate if you can't close during the rate lock period. If you're purchasing a home, review your contract for the estimated closing date to help you choose the right rate lock period. If you are refinancing, in most cases, your loan could close within 30 days. However, if you have any secondary financing on the home that won't be paid off, allow some extra time since we'll need to contact that lender to get their permission.

If you think rates might drop while your loan is being processed, take a risk and let your rate "float" instead of locking. After you apply, you can lock in your rate after your loan has been reviewed by the underwriter and the okay has been granted to lock in the rate and points.

-

-

What Is Your Rate Lock Policy?

-

General Statement

The interest rate market is subject to movements without advance notice. Locking in a rate protects you from the time that your lock is confirmed to the day that your lock period expires. TFCU provides borrowers with the option to lock in the interest rate and points once the file has been reviewed by the underwriting area or to float the rate and points until five days prior to closing.

Lock-In Agreement

A lock is an agreement by the borrower and the lender and specifies the number of days for which a loan’s interest rate and points are guaranteed. Should interest rates rise during that period, we are obligated to honor the committed rate and points. Should interest rates and points fall during that period, the borrower, must honor the lock. Note: Any changes to the conditions of the loan locked may affect the rates and points to be charged on your loan. These conditions include, but are not limited to: Loan-To-Value based on appraised value of the property, transaction type, property type, number of units, loan program, purpose, occupancy, loan amount and if subordinate financing applies.

When Can I Lock?

Your interest rate and points can be locked once you have submitted a complete loan application with all required supporting documents and your loan has been pre-underwritten or reviewed by an underwriter and approval to lock in the loan has been granted.

Fees

We do not charge a fee for locking in your interest rate and points.

Lock Period

We currently offer a 45 day lock-in period. This means that your loan must close and disburse within this number of days from the day your lock is confirmed by us.

Lock Confirmation

Once you have requested to lock in your rate and points, a Rate Lock-In Confirmation notice will be sent to you to review and sign. The confirmation will outline the specific details regarding your lock selection. Please read this document carefully. If you have any questions, please contact your Mortgage Loan Originator.

Lock Changes

Once we accept your lock, your loan is committed into a secondary market transaction under the terms and conditions of the loan and lock. We will not be able to renegotiate the lock commitments unless the terms and conditions on your loan request change and the changes affect the rate and/or points to be charged on the loan. In addition, it is understood that if the loan funds after the expiration of the lock-in period, that the prevailing rate and points in effect five days before my closing date or the original locked-in rate and point(s) whichever is higher will apply.

-

Have a Question but Don’t Want to Wait On Hold?

We Have Simplified Home Buying For Others Like You

I would recommend this credit union to anyone who is looking to take out financing on a car and I will definitely be taking my mortgage here when fed rates come back down.

Daniel

TFCU Member

This place is like a rock compared to any other place I know about. If you're looking for loans, mortgages or just a place to bank you should look here.

Kimberly

TFCU Member

Nothing but good experiences here and I use them for my credit cards, checking, savings, and mortgage. Highly recommended.

Matt

TFCU Memebr

Disclosures

* APR = Annual Percentage Rate. The interest rates, annual percentage rates (APRs), points and rebates shown are subject to change without notice. The points reflected above are Discount Points paid to lower your rate. TFCU may also charge origination fees. The actual interest rate, points, and annual percentage rate offered may differ depending on your credit qualifications, credit scores, loan to value ratio, type of property and transaction type, as many factors apply to mortgage loan financing. Rates and points will not be locked until a complete application with all the required supporting documents have been provided and a review of the file has been completed. Rates can be locked for up to 60 days. Minimum Loan amount $40,000. Maximum conforming loan amount is $832,750. Jumbo loans may be available for loans amounts above $832,750 to $2,500,000. Financing is available for second homes and investment properties. Condominium financing is also available for up to 95% of the loan-to-value ratio for purchases. Some restrictions may apply. TFCU will deposit the $1 minimum requirement to open your account.

Property insurance is required; if the collateral is determined to be in an area having special flood hazards, flood insurance will be required as well.

Rates and Offers are subject to change without notice.

Results of the mortgage affordability estimate/prequalification are guidelines; the estimate is not an application for credit and results do not guarantee loan approval or denial.

** The HomeAdvantage™ program is made available to you through a relationship between Tropical Financial Credit Union and CU Realty Services. Program cash rewards of 20% of the realtor fee are awarded by the realtors in the program associated with CU Realty Services to buyers and sellers who select and use a real estate agent in the HomeAdvantage network of approved agents. Home buyers or sellers are not eligible for the rebate if they use an agent outside this network. Using your credit union for a mortgage is not a requirement to earn a rebate. Rebate amounts are dependent on the commissions paid to the agent. Your credit union may have specific rules on how your rebate will be paid out. Rebate incentives are available in most states; however, are void where prohibited by law or by the lender. Please consult with your credit union to get details that may affect you.